At the end of last year, the IRS raised the fee that insurers or sponsors of self-insured health plans pay annually to fund the federal Patient-Centered Outcomes Research Institute (PCORI) trust fund. The new fee is $2.79 per covered person, with other fees described below.

The fee is typically due on July 31 each year, but for 2022, the fee is due Aug. 1, as July 31 falls on a Sunday this year.

The fee applies to health plans for the preceding calendar year. According to IRS Notice 2022-04, the annual fee adjustments are as follows:

- For plan years that ended on or after Oct. 1, 2021, and before Oct. 1, 2022 (including calendar year plans), the fee is $2.79 per person covered by the plan—employees and dependents—up from $2.66 a year earlier.

- For plan years that ended on or after Oct. 1, 2020, and before Oct. 1, 2021, the fee is $2.66 per person, up from $2.54 the year before.

However, according to a March 4, 2022, update of the IRS Q&As on PCORI fees:

- After Sept. 20, 2021, and before Oct. 1, 2022, the applicable dollar amount is $2.79.

- After Sept. 30, 2020, and before Oct. 1, 2021, the applicable dollar amount is $2.66.

Self-insured employers pay the annual PCORI fee directly to the IRS. For fully insured employers, the fee is paid by the insurance provider, although the cost may be factored into premium increases.

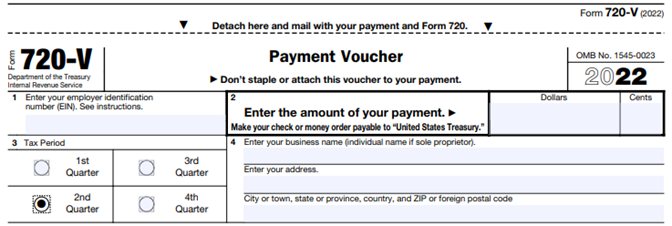

Fees are reported and paid annually with the submission of IRS Form 720 (Quarterly Federal Excise Tax Return), and are due by July 31 of the year following the end of the plan year, unless that date falls on a weekend or federal holiday.

Fee Applies Through 2029

The Affordable Care Act created the fee to fund a Washington, D.C.-based institute that conducts research on the comparative effectiveness of medical treatments. The fee was originally to apply only to plans with terms ending after Sept. 30, 2012, and before Oct. 1, 2019. However, as part of the Bipartisan Budget Act of 2019, annual PCORI filing and fees were extended for an additional 10 years, through 2029.

“The PCORI fee is calculated using the average number of lives covered under the policy or plan and the applicable dollar amount for that policy year or plan year,” explained William Sweetnam, the legislative and technical director at the Employers Council on Flexible Compensation in Washington, D.C. “The applicable dollar amount was $2 when the fee was enacted as part of the Affordable Care Act, and that amount is increased annually based on increases in the projected per capita amount of national health expenditures.”

Calculating PCORI Fees

The IRS provides self-insured employers with options for determining the average number of plan enrollees, which the IRS refers to as covered lives—employees, spouses and dependents covered by the health plan. According to the IRS, plan sponsors may use any of the following methods to calculate the average number of covered lives under the plan:

- The actual count method. Plan sponsors add the total of lives covered for each day of the year, divided by the total number of days in the plan year.

- The snapshot method. Sponsors add the total lives covered on one date in each quarter of the plan year.

- The snapshot factor method. Similar to the snapshot method, the number of lives covered on any one day may be determined by counting the actual number of lives covered on that day or by treating those with self-only coverage as one life and those with coverage other than self-only as 2.35 lives.

- The Form 5500 method. Plan sponsors use a formula that includes the number of participants reported on the Form 5500 for the plan year.

The IRS posted a chart showing the application of PCORI fees to common types of health coverage.

FSAs, HRAs and Other Benefits

Generally, health flexible spending accounts (FSAs) are considered excepted benefits and therefore do not require a Form 720 and PCORI fee payment “unless the employer—and not just the employee—makes contributions to it that exceed the lesser of $500 annually or a dollar-for-dollar match of the employee’s contribution,” said Gary Kushner, president and CEO of Kushner & Company, an HR strategy and employee benefits consulting firm in Portage, Mich. “In that event, those FSAs must also be included in filing the Form 720” with appropriate per-enrollee payment.

For health reimbursement arrangements (HRAs), employers should “first look at the integrated group health plan,” Kushner advised. “If the [health] plan is fully insured, then the employer must file the 720” and pay the fee for each employee with an employer-funded HRA. The fee is paid per employee, and spouses and children covered by the fully insured health plan are not included in the fee calculation.

“If, however, the underlying group health plan is self-funded, then no separate 720 need be filed for the integrated HRA, but rather, one filing and fee for the self-funded group health plan is due,” Kushner noted. In this case, the fee is calculated based on covered lives, not just employees.

While the insurance carrier is responsible for paying the PCORI fee for the fully insured medical plan, “the employer is responsible for paying the PCORI fee on the HRA,” wrote Karen Hooper, vice president and senior compliance manager at Newfront, an insurance and financial services firm in San Francisco. “The IRS is essentially double-dipping in this scenario by imposing the PCORI fee on the same lives covered by both the major medical and the HRA. In recognition of this, the HRA PCORI fee paid by the employer is determined by counting only one life per employee participating in the plan (and not dependents).”

The PCORI fee does not apply to health savings account (HSA) participants, as HSAs are individual accounts, not group health plans.

The fee also “does not apply to dental and vision coverage that are excepted benefits (whether through a stand-alone insurance policy or meeting the ‘not integral’ test for self-insured coverage),” Hooper explained, and “virtually all dental and vision plans are excepted benefits.”

Missed Payment Deadlines

“An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee),” advised Ethan McWilliams, a senior compliance analyst at Lockton, a benefits broker and services firm based in Kansas City, Mo.

Employers in this situation should be sure to use the form for the appropriate tax year.

“The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause,” he noted.

Future Fees

The PCORI fee dollar amount is adjusted yearly to reflect inflation in national health spending, as determined by the Secretary of Health and Human Services (HHS).

“Due to the fact that [HHS] did not publish updated National Health Expenditures tables for 2021, this year’s fees are based on the projections set out in the 2020 tables,” according to a client alert by law firm Fraser Trebilcock in Lansing, Mich. “As such, plans should pay close attention to next year’s fee changes,” which could reflect multiple years of health care inflation.

[Need help with legal questions? Check out the new SHRM LegalNetwork.]